How to meet Net Zero obligations in challenging economic times

Context

- Universities are facing increased pressures to deliver Net Zero (“NZ”), with students calling for action and commitments in addition to UK government targets.

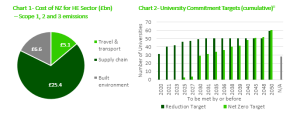

- Whilst the UK government has committed to public sector buildings reaching NZ by 2050, several universities have committed to earlier targets, with 29 institutions targeting NZ or better by 2030.

- A joint report by BUFDG, EAUC and AUDE estimates that reaching NZ will cost the sector c. £37.1bni. Supply chain emissions, the majority of which are Scope 3 emissions, represent 36%i of the sector’s emissions and will require the largest spend to reduce.

- It is estimated that £6bni of investment in building infrastructure is required to transition existing assets to NZ, with some universities required to make large and complex upgrades to heritage assets.

- The investment required comes during a period of headwinds for the Higher Education (“HE”) sector, including higher interest rates, a rising cost base and frozen tuition fees. Changes to the policy environment and visa regulations have also increased volatility in international student recruitment, impacting on forecast income.

- Trends show declining surpluses, net operating cash flow and liquidity. In May 2024, the Office for Students (“OfS”) reported that 43 institutions are anticipating accounting deficits for three consecutive years. There are more than 60 universities across the UK currently undertaking some form of redundancy or staff restructuring scheme. The cost of achieving NZ is unlikely to be met within current budgets alone.

What can universities do?

- Understand current emissions – Use tools available to the sector to understand current energy consumption, perform estate surveys of upgrades required and understand wider supply chain embedded carbon.

- Set Targets & Policy – Many universities have already set NZ targets, but a proportion have only set short term reduction targets or no target at all. Estates, Finance and senior leadership need to work together to set targets. Targets will be institution specific due to the nature of work required and ambitions / budgets to reduce Scope 1, 2 and 3 emissions. A clear policy and outline plan will need to be developed to achieve these targets, which needs to be driven by senior leadership with engagement from estates, finance and procurement.

- Develop strategy – A strategy of transition will be required including (but not limited to) university capital plans for improvements in building fabric, energy efficiency measures and electrification of assets. Assess the university’s energy strategy including Power Purchase Agreements (“PPAs”), on-site generation and potential heat networks. Strategy development will need to include a whole institutional plan requiring input from all departments, specialist technical support can assist with strategy and planning.

- Financial Planning – Delivering a NZ plan will require significant capital investment. Estates and Finance functions should work together to understand levels of investment required to meet NZ targets and identify sources of funds and potential commercial structures. Key considerations include:

- Sources of funding – on or off-balance sheet, university cash, on-balance sheet borrowing, ESG linked borrowing, grant funding and project finance partnerships.

- Commerical structures – Third party funding such as project finance could potentially be used to supplement funding provided by the university where a separate income stream can be created to remove or eliminate the upfront cost to the university (discussed overleaf).

What alternative structure are available for energy related projects?

- Energy service companies (“ESCOs”) – standalone companies that provide energy services, including the design, implementation, and financing of energy generation or efficiency projects.

- Energy performance contract (“EPC”) – an agreement based on energy usage and savings, which often delivers retrofits or energy efficiency measures. An energy service provider will design, finance and implement the improvements, in return, being paid from the energy savings it generates. It may involve some loss of control of asset operation.

- PPAs – an agreement for the purchase of energy from a generator, often a fixed price. Can be structured for on or off-site renewables. They can be attractive to both sides, as a university fixed price PPA can help underpin revenue projections for the operator while delivering price certainty for the university.

- Leasing – asset finance for less integrated equipment, such as solar PV or heat pumps.

About QMPF

- Dedicated energy & education teams who work on remits across the UK.

- In the last 5 year, advised on over 30 major transactions and business cases in HE.

- Advised on over 50 major transactions in the renewables sector and c. 3GW of renewable energy projects.

Case Studies

More News…