University-led Student Accommodation: Changing Demands, Emerging Opportunities

For students, living matters as much as learning

Student recruitment is key to the financial sustainability of universities. Many institutions have strategically targeted growth in their student population, particularly internationals, to offset the impact of fixed domestic undergraduate tuition fees, which have eroded in real-term value over the years. Recruitment is highly competitive and requires institutions to market their student experience effectively. The availability, quality and pricing of student accommodation are vital in this effort and significantly impact student satisfaction.

Key challenges to meeting the demand for student accommodation

Many universities face a shortage of quality, affordable local accommodation. In some locations this has intensified following growth in students, coinciding with a slowdown of new build construction and a reduction in the availability of HMOs (“Houses in Multiple Occupation”). University-owned stock often also includes a high proportion of dated bedspaces in need of modernisation. Key challenges affecting the supply of accommodation include:

- Construction cost increases to around £110k to £150k per bed, being driven higher by materials and labour costs, coupled with stricter safety, environmental and energy performance regulations.

- Higher borrowing costs, which since late 2022 have been based on prevailing gilt yields/SONIA rates of more than 4.5%, far exceeding funding costs over the previous decade.

- These factors have affected project viability and made it increasingly difficult to deliver affordable accommodation, particularly in non-premium markets. Minimum viable rents to support new PBSA (Purpose Built Student Accommodation) will now normally exceed £200 per week.

- Student affordability is major issue, as rental inflation has outstripped maintenance loans in many locations. According to a HEPI / Unipol 2024 report, the average student rent in London in 24/25 (£13,595) now exceeds the maximum student maintenance loan of £13,348.

- International student recruitment is volatile. Global trends (such as the falling Nigerian currency), UK visa policies and student preferences can all create significant year-on-year fluctuations in local markets. This volatility makes forecasting demand more complex and has contributed to a ‘flight to quality’ trend among investors.

- The planning process is increasingly complex and developers must also comply with Building Safety Act 2022 (“BSA”) requirements for buildings of more than 11m or 5 storeys in height. The BSA process requires gateway steps before construction and occupation, including additional regulatory approval for ‘higher risk’ buildings of 18m+. Unite is quoted as warning that the BSA will typically add six months to a development, which is consistent with our own experience, and poses a particular challenge for PBSA given the imperative to deliver for the start of term time. (Trading Update and Q3 Fund Valuations – 07:00:04 08 Oct 2024 – UTG News article | London Stock Exchange)

These challenges are evidenced in the slowdown in PBSA construction activity since 2022, despite strong student demand. Analysis by StuRents estimates that around 12,500 beds were added in 2024, which is significantly below the pre-2020 trend, which ranged from 25,000 to 35,000 annually. The new supply and planning pipeline is also concentrated in several major cities: London, Bristol, Glasgow, Nottingham, Leeds, Edinburgh and Manchester – which are all characterised by strong rent levels and the presence of Russell Group universities.

How to address the accommodation shortfall? Are partnership models the answer?

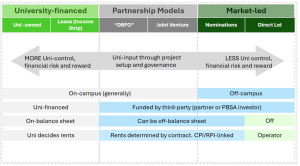

The scale of capital investment required to deliver and maintain quality student residences is significant. Both universities and private sector developers are increasingly exploring partnerships as a means to solving these challenges. Universities will generally have access to the lowest cost sources of funding of all the options – in theory – however, financial pressures and balance sheet constraints mean that direct funding for student residences often cannot be prioritised. For universities, partnership approaches can help diversify funding sources, limit university balance sheet commitments and share risk, while drawing upon private sector development and operational expertise.

Partnering with universities can provide developers with access to large, high-quality projects, wider university relationships and reduce their cost of capital (relative to a direct let development) by de-risking the project and stabilising demand.

- Design Build Finance & Operate (“DBFO”) models are normally based on a concession agreement of up to 50-years and the grant of a headlease on university-owned land, which reverts to the university at maturity. The project agreement will confer the university the rolling annual right to nominate, but without providing a fixed occupancy underwrite, although other protections are provided to the partner and its funders (such as a restrictive covenant). DBFOs have been the most common route for universities to raise off-balance sheet third party investment for on-campus accommodation, delivered to their specification.

- Joint-ventures (“JVs”) are bespoke and can take various forms. A prominent recent JV in the sector is Unite’s agreement with Newcastle University for the provision of up to 2,000 beds at its Castle Leazes site announced in 2024 Unite press release. The University will own a 49% stake in the JV and contribute land under a 150-year lease, while Unite will act as developer and asset manager. These emerging joint venture structures may involve longer-term land interest sitting with the JV-partner and a more material university equity stake (20-49%) than under a DBFO.

Both of these approaches can be tailored to meet specific project objectives, and deliver amenities such as gyms or learning hubs and renewable energy technologies. Investors also have appetite for refurbishment of existing university assets, which can generate a capital premium for the University under the right conditions. There is also flexibility in DBFO structures for universities to retain services, such as pastoral case, security or Soft FM, if desired.

How to identify the best approach for your circumstances?

Understanding local market dynamics is crucial to identifying the best funding approach and building a sensible commercial case, including the factors that influence student demand, competing supply and rental levels. Financial viability is the key challenge affecting all developments. This must be modelled carefully to assess deliverability, taking into account all relevant project ‘levers’ and the potential appetite and terms available from investors for a given scheme, structure or location.

Private sector student accommodation operators and investors remain keen for university partnership opportunities. Appetite can be enhanced if universities adopt an efficient procurement route (to minimise bid costs and time at-risk), present the opportunity effectively and structure deals on an appropriate commercial basis. We have experienced heightened scrutiny of university resilience and financial sustainability from funders (and increased credit differentiation between institutions) however core student demand for on-campus schemes remains generally robust.

How we can help

We have experience of structuring projects, including joint ventures and “DBFOs”, leading procurement processes and providing financial advice across all project stages from initial feasibility work to reaching financial close. We can manage the commercial interface between universities and the private sector. We can assist you with:

- Financial modelling to assess project viability and potential rent strategies

- Options appraisals and business cases

- Comparing ‘self- financed’ options with the partnership alternatives (DBFO, JV and nominations)

- ‘Soft market testing’ among providers and funders to help affirm options

- Arrangement of finance through bank facilities and income strips

- Benchmarking of rents, capex and operating costs across the sector, locations or peer groups

- Deal structuring and negotiation between universities and commercial partners

- Financial or lead advisor through procurement processes

- Residences portfolio financial modelling

- Support throughout university governance

We have also advised universities on the establishment of joint-ventures (with Unite, among others); and support private sector investors and operators on financial modelling, commercial structuring and raising funding for student accommodation.

Our ongoing projects comprise delivery of more than 5,000 bedspaces with clients including the University of Manchester, London School of Economics, University of Southampton and Durham University.

Please get in contact if we could be of any assistance, or for a general discussion about the market and wider opportunities.

Staffordshire University Student Village – DBFO Partnership – QMPF

University of Birmingham – Pritchatts Park Student Village – QMPF

More News…