Financial Sustainability: Managing your finances in a challenging environment

QMPF is being asked to support a number of its clients through restructuring and renegotiation of their existing borrowing. It can seem a daunting process to undertake…but this doesn’t have to be the case.

Context

There are a number of challenges being faced by the higher education (“HE”) sector including higher interest rates, a rising cost base and frozen tuition fees – which are steadily reducing in real terms. Meanwhile, the need for capital investment remains (to meet net zero ambitions and other priorities) and a shifting regulatory environment, bringing changes to visa regulations, has resulted in increased volatility of international student recruitment.

The Office for Students (“OfS”) has recently (May 2024) reported on its view of the financial sustainability of the English HE sector which noted the broad range of financial outcomes. Trends show declining surpluses, net operating cash flow and net liquidity. 43 institutions are anticipating accounting deficits for three consecutive years (2021/22-2023/24) with 93 (35%) reporting a deficit for 2022/23 – forecast to increase to 108 institutions (40% of the sector) in 2023/24 (link to OFS report).

In addition, there are currently more than 60 universities across the UK which are undertaking some form of redundancy or staff restructuring scheme, demonstrating that this is not an issue restricted to a small subset of institutions.

International student recruitment is becoming less predictable and there is a risk of overreliance on specific countries. Global macroeconomic conditions are also impacting on the willingness, or ability, of international students to apply to study in the UK.

The headwinds noted above are giving rise to increased pressure on financial covenant compliance and universities are also experiencing a greater level of scrutiny from auditors, with going concern assessment often looking forward more than one year at the point of financial statement sign off. The assessment will consider expected or potential covenant breaches, liquidity under downside scenarios, refinancing risk and relationships with existing lenders. It is therefore important to act promptly to resolve any potential issues, giving you greater breathing space to manage your financial performance.

Five Steps to Managing the Challenges

Forecasting: It is critical that the forecasting and budgeting process presents a realistic position for consideration, not too optimistic but also not overly pessimistic. Scenarios can be used to plan for positive performance but demonstrating resilience under realistic downside assumptions. Performance against financial covenants will be one of the key outputs and areas of assessment. You may find that a temporary rebasing of covenants or potentially a partial waiver is required.

Funders will want to review the forecasts in detail and understand the underlying assumptions being made regarding student recruitment and operating costs. They will also want to consider specific “upside” or “downside” cases which have been prepared and the rationale for these. The selection of the “base case” forecast will be important for proposing an acceptable outcome for both the university and funders.

Understand your options: Where actions are required, there should be a thorough and transparent review of the current operating position to consider how turnaround can be achieved, within the context of your strategic plan. Points to consider include:

- Capital expenditure: can some of this be paused or the spend profile extended, reducing outlays in the next few years? Could some projects be funded by third-party investment?

- Existing assets / rationalisation: is it possible to dispose of any existing assets to generate cash? Can utilisation of the existing estate be improved, reducing the need for development of additional facilities?

- Staff Redundancy schemes: although understandably these are not popular, they are unfortunately required in some cases to lower the cost base.

The sector has been (and remains!) an attractive proposition to funders via traditional bank lending and institutional investors offering private placements (“PP”) or income strips (indexed leases). As the availability of longer tenor bank facilities reduced, universities accessed capital markets to obtain longer term debt through private placements from institutional investors. There is a range of existing lenders to the sector (also including legacy European Investment Bank loans) and single universities will often have to agree covenant amendments with multiple lenders and investors. In our experience, funders are keen to highlight their ongoing support for the sector and willingness to assist with any potential amendments required.

Covenant Amendment or Renegotiation: With these mitigating actions layered into your forecasts, you can then assess potential financial covenant solutions for discussion with your funder(s). We recommend to our clients that rather than look to the funder to provide its preferred amendments, they should pro-actively provide a solution which includes:

- the reasons for changes in forecast performance;

- mitigating actions being taken;

- proposed amendments to financial covenants (if required); and

- revised financial forecasts.

This will not necessarily be the final, agreed position but provides a strong starting point and gives the funder confidence that sufficient review has been undertaken.

In some cases, there may be a cost associated with the covenant amendment solution. Funders can expect a quid pro quo for their cooperation, which could manifest as a one off fee, an increase in the credit margin or reduction in loan maturity or size. Legal costs (your own and those of the funder) may also be payable depending on the extent of documentation amendments.

Funder Engagement: Generally, we believe in detailed, regular communication with funders to build goodwill and provide for better outcomes. PP investors can take a more passive approach to borrower engagement than relationship banks. Some PP investors will depend upon external legal counsel to advise them during a negotiation (fees paid by the borrower), as they may not have this type of internal expertise. Banks, on the other hand, prefer frequent engagement and provision of management information and have their “in house” views and credit specialists with particular preferences.

We believe that funders are best approached with a clear description of the issue and a realistic solution, including proposed changes to legal drafting or covenant definitions. This allows the funders to more easily navigate their credit process and initially “anchors” the negotiation in the borrower’s favour.

A clear timeline and rationale for the amendment should be provided, allowing all funders to work to the same date.

Debt Restructuring – Repayment or Refinancing: Depending on the structure of your existing debt and hedging arrangements, there may be a benefit in repaying this facility early. It could be replaced with a new facility or simply repaid from cash reserves if these are sufficient.

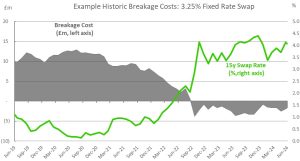

There are still institutions with long term bank loan facilities dating back to the mid-2000s (pre financial crisis) with fixed rate interest rate arrangements. While prevailing interest rates were low, there would normally be a breakage cost associated with early repayment of these facilities. However, as prevailing rates have risen, these are often now in a position where a breakage gain is payable. This is a payment to the university which nets off against any capital repayment. A review of your specific loan agreements and swap documentation will be required but generally, if current market rates are higher than the rate of your loan, a breakage gain would be payable by the funder and if they are lower than the rate of your loan, you will have to make a breakage payment to the funder.

The chart below provides an example of how swap valuation can move relative to the 15 year SONIA swap rate. This example assumes the existing loan has a 3.25% fixed rate.

The sector has taken a measured response to the higher interest rate environment and increasing cost base with gearing levels, measured by ratio of borrowing to income, reducing from an average of 33% to 30% between 2021/22 and 2022/23. This is forecast to reduce further to c. 25% by 2026/27.

Repaying existing debt will deliver cash flow benefits as you no longer have ongoing debt service obligations however, if not replacing with new debt, reserves will have been diminished and this may impact on your longer term expenditure plans.

How can QMPF Assist?

We can provide support to universities in navigating this environment, evaluating any debt restructuring options and assisting in delivering solutions. Our experience supporting the sector is longstanding and we have good relationships with its primary funders. We can support you through:

- Forecasting: preparation of financial forecasts / models is at the core of our work and it is critical that any forecasting which is developed is robust and transparent. QMPF can assist in development of your forecasts or undertake a review of existing forecasts, acting as a “critical friend”, prior to circulation to funders.

- Understanding the market and lender engagement: The core of QMPF’s activity lies in Higher Education having worked with numerous HEIs and supported the sector for over 20 years.We have strong relationships with across the funding market and are in regular contact as part of our wider market engagement. These relationships allow us to have candid discussions with key funder contacts during the process and we find that this approach deliver the best outcome for our clients.We believe that a skilled intermediary can help find solutions and reduce the workload of internal finance teams during periods of potentially difficult circumstances.

- Refinancing and Arrangement of New Facilities: We are currently active with a number of clients, supporting them with a review of debt options, covenant negotiations, repayment of existing borrowing (incl. benchmarking of any early termination gain / cost using Bloomberg to access live market data) and procurement of new facilities. Our market coverage means that we can provide you with visibility of the full range of refinancing options.We have worked on complex private placement covenant renegotiations, restructurings and consent solicitations for a range of universities – on certain engagements, these have often taken place in parallel with new debt raises or restructuring of existing facilities.

- Liquidity and Treasury Management: As part of this process, you may choose to refresh your wider treasury management policy or benchmark your approach to liquidity. We are retained by several clients to provide ongoing strategic and treasury management advice leveraging innovation and technology where possible to allow HEIs to make better, more informed strategic decisions.

More News…